Looking to sell your property fast but not sure who to trust? Complete our contact form

Critical Analysis:

When you’re selling your property, it’s of vital importance to know who you’re working with.

In here, you’ll find everything you need to know about Springbok Properties and whether you should trust them to sell your property quickly.

Want to hear who we recommend above Springbok Properties and why?

While others will try to lock you into a contract which is rarely in your benefit. Click the button below for a free, no obligation cash offer from My Homebuyers.

Company

Established in

2008

Members of NAPB

Yes

Members of TPO

Yes

Registered with ICO

Yes

Approved by CTSI

No

Will “Springbok Properties” pay all of your legal fees?

Sometimes

Do they ask you to sign a contract?

Yes, always

Government verified transactions

No

Cash offer

Average sale time

41 days

Fastest sale time

7 days

Availability

24 / 7

Complaints procedure

Yes, great

Customer service

4.0 / 5

Google rating

4.0 / 5

Trustpilot rating

4.5 / 5

Reviews.co.uk rating

N / A

Feefo rating

N / A

Springbok Properties are one of the better known UK house buyers. Their cash offers are reasonable and fair, as long as you have the right expectations.

They aren’t fully transparent with their fee structure and they aren’t the fastest sellers in this market but they are excellent in terms of GDPR and customer data safety.

4.1 / 5

(source: Companies House)

Springbok Properties is a fast property buying company that claims to be a cash buyer

At a glance they do seem to set a high industry standard with their 24/7 customer service, full transparency, speed of execution and competitive cash offers.

The firm provides nationwide coverage with a local focus and aims to help people sell their home in a matter of weeks for a realistic price.

They claim to provide bespoke, tailor-made and flexible service at all times.

And they claim to only work with qualified buyers so no time is wasted when trying to sell your property.

Whether all of that’s true, will be revealed in this review.

When working with them, they’ll buy the property from you at a price that satisfies both parties involved, and then sell it for a profit.

You’ll get a slightly below-market price but you’ll achieve a prompt and effortless sale with little bureaucracy.

Springbok Properties provides free valuations and you’ll only pay fees upon a successful sale.

They can give you an immediate, no-obligation quote and purchase your property in as little as 1-2 weeks.

This type of sale is perfect for people in a rush, who don’t have time for unnecessary red tape.

It’s important to remember:

You won’t get the full market value of your property but you’ll sell it very fast.

In fact, this is by far the fastest way to sell. A typical estate agent will take 6-9 months whereas a fast home-selling company can do it in mere days.

You’re sacrificing a negotiable percentage of cash for an exponential increase in speed-of-sale and a major reduction of headaches and legal complications.

Springbok Properties aims to provide an unparalleled fast property sale service, obtaining the most optimal price while giving the best service humanly possible.

The firm claims to have an exceptional customer-centric ethos.

And they do seem to back up this claim by providing 24/7 customer service, instant cash offers and a team of experts readily available to help.

Springbok Properties state that they don’t view ‘customer service’ as a department but a job requirement for every single one of their employees. This kind of attitude is very commendable.

But is Springbok Properties really so prolific when it comes to customer satisfaction or are they making misleading claims in order to lure in vulnerable people?

We’ll explore all of this bit by bit in the sections below.

With Springbok Properties you only pay fees upon a successful sale of your property and there are no hidden charges.

Yes, Springbok Properties is a member of the NAPB.

The National Association of Property Buyers (NAPB) was specifically set up to protect homeowners looking to sell their houses for cash to a property buying company.

The NAPB continuously screens its members in order to see whether they’re maintaining the necessary business integrity, legality, professionalism and customer service.

It’s mandatory for all NAPB members to also register with The Property Ombudsman (TPO) and abide by the TPO ‘Code Of Practice For Residential Buying Companies’.

However, being an NAPB member is completely voluntary. Nobody forces these cash home buyers to become members, they do it of their own volition.

And just like the other reputable companies in this market, Springbok Properties wants to be regulated by the NAPB in order to ensure greater customer satisfaction.

Yes, Springbok Properties is a member of TPO.

The Property Ombudsman (TPO) defends the interests of the public by investigating and addressing complaints of maladministration or a violation of rights.

It has been providing consumers and property agents with an alternative dispute resolution service since 1990.

TPO has a specific category for fast home sale companies, such as Springbok Properties.

These companies have to adhere to a strict ‘Code of Practice for Residential Buying Companies’.

Springbok Properties is regulated by TPO and strictly follows the above mentioned TPO code of conduct.

Just like the other leading companies which are also members of TPO, this is another significant benefit of working with Springbok Properties.

Yes, Springbok Properties are registered with the ICO.

The Information Commissioner’s Office (ICO) is the UK’s independent regulatory body set up to uphold information rights.

The ICO also governs all forms of data collection and advertising intelligence.

By being registered with the ICO, Springbok Properties has to protect its customers’ data at all times.

The ICO also has a Free Online Checker where you can verify whether a company is registered with them or not.

Springbok Properties is registered with the ICO which further solidifies their authenticity.

They are fully GDPR compliant.

From our independent investigation, we discovered that Springbokproperties.co.uk is fully GDPR compliant with the “safety of personal data collection forms”.

We didn’t find any not GDPR-friendly marketing cookies on Springbokproperties.co.uk.

Nevertheless, this is a contested topic and it’s virtually impossible to give an objective assessment.

Certain cookie types can be interpreted in multiple ways, hence some experts might deem Springbokproperties.co.uk GDPR appropriate, others might not.

That’s why we caution you to take this GDPR assessment of Springbokproperties.co.uk with a grain of salt.

It’s not certain whether Springbok Properties have cash on hand because we couldn’t verify their transaction history through Companies House.

Our investigators couldn’t find Springbok Properties’ investment vehicle within Companies House and we couldn’t validate their average monthly government-verified transactions.

This could be simply due to the fact that they are using a different company name to track and register these Companies House transactions.

We find this common practice, not only in the fast home-selling market but in many other industries in the UK.

Nevertheless, in light of these findings, we cannot cannot say for certain whether Springbok Properties have or don’t have cash on hand which they use to buy properties.

In general, we’ve discovered that very few fast home-buying companies actually have disposable cash on hand.

Most of them are unregulated small businesses or worse – individual opportunists pretending to be big organisations who deliberately mislead.

These companies don’t have their own cash but attempt to raise funds by low-balling their offer and getting finance off the back of the difference between their offer and the market value.

For this reason, it’s less risky to work with home buying companies that have government verified transactions.

Yes, Springbok Properties has traded for more than 5 years.

They have been in this industry since 2008.

We use the ‘over/under 5 years trading time’ as a metric to gauge whether a company is an established entity with a lot of experience under their belt or just a newly founded business that may have ulterior motives.

Not all newly formed companies are scams but it’s still important to check how long they have traded.

If they’ve traded for more than 5 years, then this is a minor but still notable vote of confidence.

And it needs to be acknowledged.

Springbok Properties has 2 primary modes of selling which makes it tricky to estimate their average cash offer. However, after a thorough case-by-case examination, we estimate 70-80% to be a reasonable approximation for their average cash offer.

Springbok Properties’ first mode of selling is their “Fast Sale Department” which will help you achieve a sale within 4-8 weeks and will give you up to 100% of your property’s market value.

Springbok Properties’ second mode of selling is their “Cash Buying Department” which will help you achieve a sale within as little as 7 days and will give you up to 70% of your property’s market value.

An important thing to note here is that Springbok Properties don’t state their fee structure on their website. You can only receive that after you get a free valuation.

And even though they can give you a no-obligations quote and you only pay fees upon a successful sale of your property, this lack of transparency is not ideal.

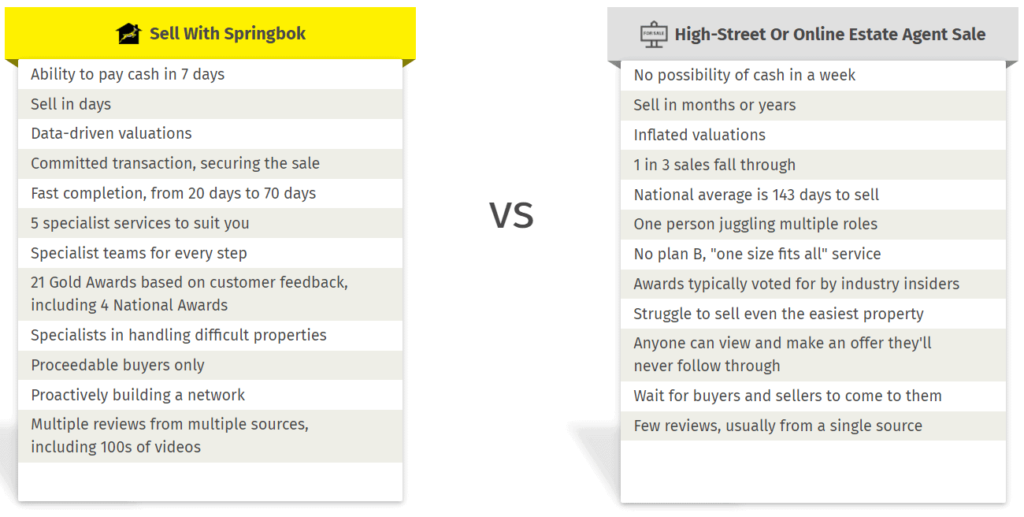

Below you can see some of the perceived benefits of using Springbok Properties instead of a generic high-street or online estate agent.

Getting 70-80% of the market value for your property when working with a fast home selling company is fair.

However, with sub-par home buying companies you’ll often get between 60 – 65%, sometimes even less.

Inferring from this, Springbok Properties gives reasonable offers in the context of fast home selling companies.

Of course this doesn’t mean that every home achieves that kind of valuation as it depends on a myriad of factors. Sometimes there are justifiable reasons why you may receive a lower offer.

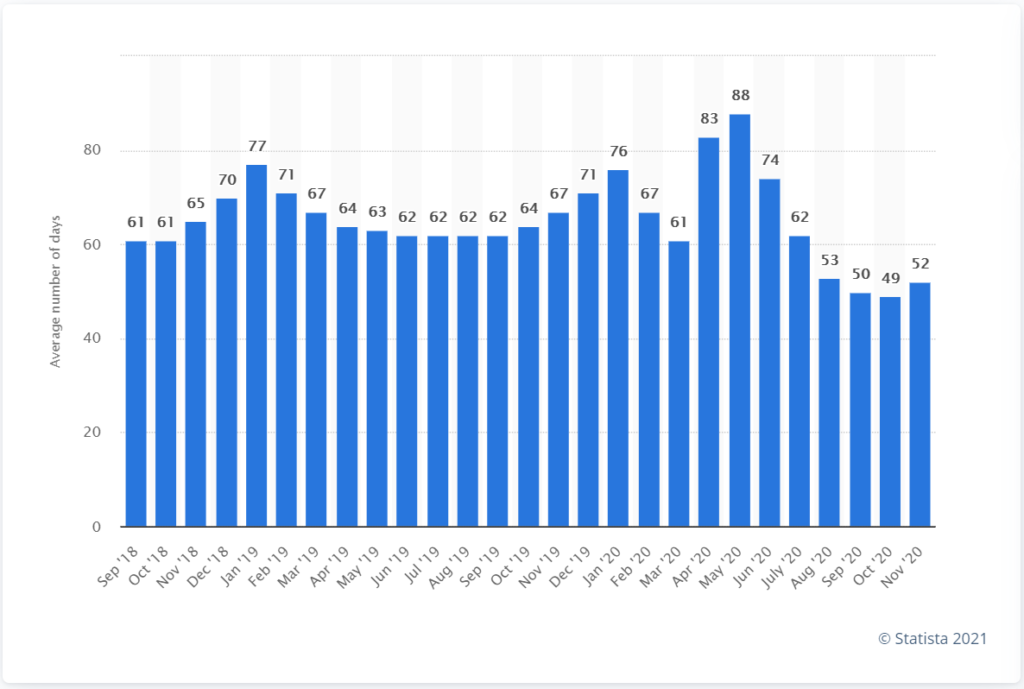

According to the latest Statista research, the average number of days taken to sell property in UK from September 2018 to November 2020 is 65 days.

This includes selling properties via estate agents, actions, fast-sale companies and everything else under the sun.

Again, this graph represents every single method of selling a property, combined together.

And because of the vast number of fast home sale companies in the UK, this number is considerably lower than what it would’ve been if it only were estate agents and actions.

Remember when it comes to speed of sale, nothing beats a quick home buying company:

Springbok Properties‘ average sale time is approximately 41 days and their fastest recorded sale time is 7 days.

Remember:

With a quick home-buying company, you’re sacrificing a negotiable percentage of cash for an exponential increase in speed-of-sale and a major reduction of headaches and legal complications.

That’s why you need to carefully consider your options.

Do you want a bit more money or do you want a significantly faster sale?

Supporting a charity is by no means proof that the home buying company in question is necessarily ‘good’.

In fact, dodgy home buying companies might purposefully support and/or pretend to support a charity just to win brownie points and credibility in the eyes of the customer.

All that being said, it’s still important to acknowledge when a company like Springbok Properties genuinely supports charitable causes such as the Cancer Research UK.

And we know with a high degree of certainty that Springbok Properties proactively support them because we personally called Cancer Research UK and asked if Springbok Properties are indeed helping them raise funds.

The answer was Yes.

You can check out Springbok Properties’ fundraiser for Cancer Research UK here.

It’s important to recognise and shed light on a home buying company’s altruistic and philanthropic aspirations but only if they are truly genuine.

If we discover even an ounce of shady behaviour, rest assured we’ll report it in our review.

We didn’t find anything that raises suspicion during our thorough research of Springbok Properties.

Our investigators sifted through all of the data and legal records of Springbok Properties and everything was clean.

However, we’ll redact this paragraph at the first glimpse of dodgy practices.

We never stop researching and our unbending commitment to excellence doesn’t waver.

This paragraph is only valid up until the ‘Last Updated’ date of this review, which can be found at the top of this page.

Springbok Properties was awarded the best estate agent branch in the UK by All Agents in 2013, 2014, 2015.

They are also FSB (Federation of Small Businesses) members and they have been approved by Trading Standards UK.

Also, Springbok Properties is a member of NAVA Propertymark and they have been independently verified by ASA (Advertising Standards Authority).

To assess the overall user experience (UX) of Springbok Properties, we first analysed their website for ease of use and intuitiveness.

They make it very easy to get a free quote/cash offer for your property within 24 hours or less.

Also, they have a FREEPHONE number which you can use to contact the company 24/7.

But they do not have a live chat feature.

For this reason, we couldn’t calculate their First Response Time (FTR).

FTR is calculated by measuring how long it takes for a company to respond after someone messages them via their live chat feature.

A faster response time suggests that the home-selling company is better equipped to deal with customer queries.

And if they’re better equipped to deal with customer queries, then it means they’re investing their resources where it matters the most.

Even though Springbok Properties don’t have a live chat feature, they make it up by providing a 24/7 freephone which you can use to contact them at any time you wish.

We also asked if they offer some sort of ‘Client Satisfaction Guarantee’, and if yes, what would that guarantee consist of.

Springbok Properties don’t currently don’t a Client Satisfaction Guarantee but as most leading home buying companies, they’re happy to help resolve any issues you may have as soon as possible.

In this turbulent market, a fast home buying company should preferably have a formal complaints procedure on their website, where clients can express any disagreements, issues or just plain dissatisfaction with the overall service.

By having such a complaints procedure in place, the home buying company shows that they are willing to listen and if possible, rectify any problems that may arise.

Springbok Properties has an excellent internal complaints procedure which can be easily accessed via their website’s navigational menu. Unlike other companies which hide theirs in the terms and conditions.

If you have a complaint, you can contact Springbok Properties on their dedicated complaints email address: CustomerServiceManager@springbokgroup.co.uk

Also, you can submit a complaint through The Property Ombudsman because Springbok Properties are a TPO member.

And every TPO member agrees to The Property Ombudsman Code Of Practice which allows customers to file complaints against TPO members, if needed.

So in the rare off chance that you are dissatisfied with Springbok Properties’ service, either contact them directly on the email outlined above or you can speak to the TPO.

A legitimate quick home buying company that does what it promises shouldn’t have a problem letting you speak to their past customers.

Of course, they need to have the permission of the individual involved and provide some kind of proof that it is a genuine past client of theirs.

We strongly encourage all our readers to ask to speak to a past client.

In this section, we’ll discuss what the public thinks of Springbok Properties and what online reviews the company has received.

Keep in mind that online reviews can be easily faked.

It works both ways.

The company in charge might hire fake review writers to write positive reviews.

Or on the other hand, their competitors might hire fake review writers to write negative reviews and tarnish the said company’s reputation.

Also, social media followers can be artificially inflated.

That’s why we deem this section as purely anecdotal.

Nonetheless, we use trained researchers with a sceptical eye to go through Springbok Properties’ social media presence and online reviews.

What’s not anecdotal is the Domain Rating (DR) and Search traffic (ST) metrics.

The Domain Rating is an internet metric that shows the strength of a website.

The longer a website has been online, generally the more other websites link back to it.

These are called backlinks. Backlinks are like a minor vote of confidence.

It’s rare to see a a scam website with a high Domain Rating. Why? Because other websites realise it’s a scam and they never give their “vote of confidence” to them.

The more backlinks a website has, the higher their Domain Rating will be.

For this reason, we only advise you to work with websites with a Domain Rating of 10 and up.

However, it’s still important to remember that virtually any online metric can be falsified or faked these days. Therefore, take this with a grain of salt and don’t give it much importance.

The Search Traffic is an internet metric that shows approximately how many unique visitors a given website has per month.

Also, this metric is an average evaluation over a period of several months.

Therefore, the more Search Traffic a company has, the less likely they are a scam.

Scam companies don’t have recurring visitors because once they scam someone, the victims protest and tell other people online to beware of the said scam company.

Also, scam companies appear less frequently in the top Google results because they usually have lower Domain Ratings. And Google only ranks websites with a high DR at the top.

This makes the scams unsustainable over a long period of time, and therefore, they cannot have a high Search Traffic.

The Domain Rating and Search Traffic are directly proportional. If the Domain Rating is high, then the Search Traffic will be high also, and vice versa.

All of the below stats and metrics have been taken as of the last updated date which can be found at the top of this review.

We didn’t find anything suspicious with Springbok Properties’ social media, TV and online presence, nor with their customer reviews.

We also didn’t find anything suspicious with their domain rating and backlink profile nor their unique monthly search traffic.

Springbok Properties is one of the leading fast home sale companies in the UK.

We thoroughly examined their strengths and weaknesses, user experience (UX), customer service and overall online presence.

They are members of the NAPB, TPO and are registered with the ICO.

They have been in this industry for more than 5 years, have a team full of experts and provide 24/7 customer service.

Their cash offers are reasonable.

They aren’t fully transparent with their fee structure and they aren’t the fastest sellers in this market but they are excellent in terms of GDPR and customer satisfaction.

They have a good internal complaints procedures and a lot of positive reviews.

We couldn’t find their government-verified transactions but that could be because they’re using a private investment vehicle. This is common practice not only in the fast home selling market but in the UK as a whole.

We will be continuously updating this review as we do with all of our other content. If Springbok Properties decide to alter, amend or modify something, then we’ll make sure to adjust our critique and score accordingly.

We want to help out as many people as possible. That’s why we created this comprehensive, in-depth Springbok Properties review.

If you are looking to sell your property extremely fast, message us through the live chat or send us an email.

Depending on your preference and circumstances, we’ll connect you for free with one of our strictly vetted, ethical partners.

They will help you sell your property as fast as possible for the best offer you can realistically achieve.

They will take care of all of the legal processes and fees and you’ll get the cash straight into your account in as little as 7 to 28 days, depending on your circumstances and preference

Springbok Properties is just one of the many fast home-buying companies in the UK.

In order to make sure you choose the right one, it’s best if you compare them all.

Look at their strengths & weaknesses, their pros & cons and make an informed decision.

It’s essential to know you’re in safe hands, that’s why we’re here to help.

Use our company comparison table to find a reliable and trustworthy service, and decide whether expediting the sale of your property is the right thing for you.

This review is being constantly screened by our investigator team and will be corrected in line with the emergence of new evidence.

If a company contacts us with a genuine and verifiable piece of information which supports their cause, then we’ll immediately redact the review and point to that information.

On the other hand, if we discover that a company which we’ve previously praised for a certain industry trait, starts to dabble in dodgy practices, we’ll also redact the review immediately.

We’ll point to our new findings and will adjust the table metrics and scores accordingly.

For this reason, make sure to take notice of the ‘last updated’ date at the top of this page.

More To Explore

The Complete Guide:

Selling & Splitting Your House After a Divorce

Read More >>

The Definitive Guide:

How to Stop Your House From Being Repossessed

Read More >>