Looking to sell your property fast but not sure who to trust? Complete our contact form

The Bulletproof Guide:

What does it mean to sell your house fast? A week? A month?

Through an estate agent, the average house sells in 12 weeks.

That’s the time from going on the market to handing over the keys.

It includes advertising, the viewing process, negotiation, and conveyancing.

Want to hear why we recommend My Homebuyers above everyone else?

We have independently investigated all the best cash home buyers in the UK.

We ranked them based on their cash offers, reliability, customer service and 15 more metrics.

And we discovered that ‘My Homebuyers’ are superior in every regard to all other companies.

My Homebuyers will give you the best genuine cash offer, without contracts and without any fees.

While other companies will try to lock you into a contract which is rarely in your benefit. Even if they claim they don’t have contracts, the truth is, they do. And they’ll force you to sign it.

Click the button below to see exactly why we recommend My Homebuyers as your best option.

And how you can use the free Safe Connect™ programme to get VIP treatment from them.

For these types of sales, we can consider anything less than that 12-week average a relatively “fast” sale.

Under 8 weeks is very fast. And under 4 weeks is extremely fast.

House buying companies, also known as “sell house fast” companies are much quicker.

Some have been known to exchange and complete in 2 days.

Now you see where they get their name from.

In this article, we’ll go over everything you need to know about selling a property fast.

Also, we’ll uncover what’s the so-called “catch” that usually makes people hesitate.

We’ll make you bulletproof to all of the traps and pitfalls in this market.

So make sure you read to the end.

Let us do the heavy lifting for you.

We’ve strictly vetted all the UK’s top fast home buyers with our cast-iron 17 point checklist.

We’ll Safe Connect™ you with the best house buyers suited to your needs until you are 100% satisfied – absolutely free.

Everyone wants the best of both worlds. To sell your house fast, and for a really good price.

But is that really possible?

Yes, it’s 100% possible to sell your house quickly and for a sensible price.

And there’s no actual catch.

But you might have to accept a couple of compromises along the way.

That’s why it’s important to have reasonable expectations and to go for a realistic selling price. But it’s equally imperative to find the right buyer.

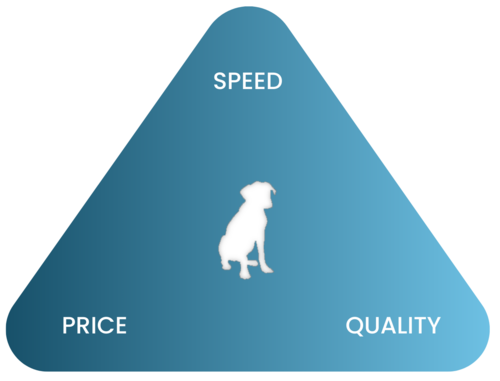

It’s useful to think of the speed-quality-price triangle when calculating your asking price.

The rule goes that you can choose only two out of the three. This applies to most products and services, including properties.

For example, you might go to an estate agent that can get you a great price.

But they might not sell your house fast.

In fact, it usually takes a few months to sell your property via an estate agent.

That’s because it takes time to find a buyer willing to pay more.

On the other hand:

You can use a “sell house fast” company. They will sell your house as quickly as humanly possible, but you might not get as high of a price.

That’s because instead of looking for a third party buyer, the “sell house fast” company will directly buy the property from you.

It usually happens within 7-20 days but some companies can do it in 2 days if that’s what you prefer.

And then the “sell house fast” company will sell your house for a profit.

You achieve an incredibly fast sale with zero headaches and you don’t have to deal with any bureaucracy.

And they get a kickback for taking on the risk and dealing with all the legal and logistical complexities.

That’s the compromise:

You have to choose between speed or price.

And in terms of quality, on either side of the coin, you can find high-quality companies that will help you sell your property.

Of course, this is a very simplified version of selling a property. There are many more variables that dictate the asking price and the speed of sale.

And there are certain things you can’t control, but there are others you definitely can.

In this article, we’re going to look at the things you can control to sell your house fast.

But before that:

Do you want to have a 5-min phone call with our recommended house buyer, simply to discuss your situation and your best possible solutions?

A zero obligations call where you speak with the actual Managing Director of our top recommended house buying firm.

We recommend people speak to him because he has an utterly ‘no-nonsense’ approach.

He’ll tell you honestly what’s your best solution moving forward and if they can help you sell your property.

In the rare off-chance they can’t help you, he’ll give you expert advice on how to proceed. You are NOT tied to any contracts.

If you want us to connect you to the Managing Director of our top recommended house buying firm, click to open our Sell House Fast safe connect page.

It takes less than 1 minute and you will get the most genuine advice in this industry.

In the UK, the fastest way to sell your house is via a house buying company.

It doesn’t matter if your property is in a good or poor condition, or if it needs repair.

It doesn’t matter if you don’t have all of the documentation required to sell a property.

A house buying company will still help you sell it in record time under any condition.

The record time you can expect to sell your house fast is between 2 and 7 days.

This is almost always achieved through a house buying company.

This turnaround is very rare with high street estate agents.

Sell house fast companies use cash to buy houses. Most of them can buy any property in any condition. They make the process as quick and painless as possible.

Big sell house fast companies have the expertise, capacity and resources to buy your property in as little as 2 days. But there’s still paperwork to do, do so it’s usually closer to 7.

Some house buying companies offer low buying prices. Some buy at 100% market value. Either way, they help you work around the usual sunk costs of selling a house. You don’t need to pay estate agency or auction fees, which are usually around a single-digit percentage of your asking price.

Without those fees to worry about, you may end up with the same final amount you’d get through an estate agent.

For this reason, if you want to sell your house fast, house buying companies are without a doubt your best bet.

Let’s say you want to sell your house quickly and for a good price. But you’d rather use a traditional estate agent.

There are two parts to selling your home quickly.

Finding a buyer, and going through conveyancing.

Many people think the first is the hardest part or that both are equally difficult and time-consuming.

But it’s often the conveyancing that weighs the most and drags on for months.

Quick reminder:

Conveyancing means the legal process that comes after your sale is agreed.

It involves local searches, enquiries from your buyer’s solicitor, and the transfer of property deeds.

It can take anywhere from several days to several months.

We’re going to explore how to speed up conveyancing in later in this article. But first let’s look at how to find a good buyer at a good price.

Your house price needs to be in line with others around it.

If you live on a development or a street of terraced houses, your sale price can’t be 15% higher than very similar ones nearby. Buyers are very savvy. They can easily find accurate pricing information online.

If you want to generate lots of interest and sell your house fast, getting your price right (rather than high) is the key.

You can find the “right” price by booking three valuations.

Book a mix of local and national estate agents to get varied opinions.

You might be tempted to go with the highest value. But sometimes agents “overvalue” to secure your business. The best approach is usually to go with an average of the three valuations.

Don’t be afraid to do your own research too.

Here’s the kicker:

A good condition can help to sell your house fast at fair market value. If your house is the most dilapidated on your street, you won’t get the same price as your neighbour. You might also have to wait longer for the right buyer.

You’ll need someone prepared to take on a project. This may cut elderly people and families out of your buyer pool, which can slow down the time to find a buyer.

We’ll talk more about how to improve you property’s condition in sections 3.2. – ‘What to fix up when selling a house?’ and 4 – ‘How can I add value to my house?’.

In short:

If you’re priced at fair market value for your location and property condition, you should be able to sell your house quickly.

The point of fair market value is that everyone agrees on the price.

This includes buyers, sellers, estate agents, mortgage lenders, and the general market.

The only reason you wouldn’t sell at market value is if the market is very slow.

This can happen in times of uncertainty. Things like elections, recessions, political crises, and high unemployment levels can all play a role.

The most common kind of tax we pay on houses is stamp duty.

However, if you’re selling: you’re not liable. The buyer is the one who has to pay stamp duty.

The other kind of tax related to house selling is Capital Gains Tax (CGT).

You usually need to pay Capital Gains Tax if you’ve sold an asset that’s increased in value since you bought it.

Houses often increase in value over a period of years. So do you need to pay Capital Gains Tax when you sell your house?

Good news:

Most people don’t need to worry about paying CGT.

You don’t need to pay Capital Gains Tax on a property that’s your sole residence. That means you live in it full time.

In some cases HMRC can question if you live there full time.

You’ll need to have things like utility accounts set up and regular bills being sent there.

It also helps to be on the electoral roll at that address.

You will likely need to pay Capital Gains Tax when you sell a second home. Or third or fourth, depending on how lucky you are.

Capital Gains Tax may apply to any homes you sell which are not your main residence, like rental properties.

You will also need to pay Capital Gains Tax if you purchased as a property developer through a business.

If your aim was solely to make money, you might be liable for Capital Gains Tax. This applies if you “flip” houses (buy and sell on a quick turnaround).

There’s another group of people who might be liable.

This one’s important given how many of us work from home nowadays.

Simply put:

You might be liable for Capital Gains Tax if you’re using part of your home as business premises only.

This might mean a room, office, shop, or farm building on your property that you make money from.

Many of us have home offices. If you have a room that’s only used as an office, you might be liable.

If you think this might apply to you, here’s how it works.

You calculate the percentage of your house your “business premises” take up.

That percentage is then deducted from the profit you make. The amount is only deducted when you sell your house.

Most people don’t need to worry too much.

If your office has a mixed purpose, you won’t be liable. If there’s a bed in your office, or you store bikes in your working studio, that counts as mixed purpose. This means you won’t need to pay CGT.

Most people don’t need to tell HMRC when they sell their house.

The only time you need to inform them is when you owe Capital Gains Tax.

Not telling HMRC you’ve moved doesn’t mean they won’t know.

They’ll be able to find out you’ve sold your house through Land Registry records.

They might also find out if you change your tax payments.

For example, if you’ve sold a rental property, you will stop declaring rental income for it.

If they suspect you owe Capital Gains Tax, they can use this information to investigate.

If you skipped the section above ‘Do you pay tax when you sell your house (UK)?’ refer back to it to work out if you’re liable.

A chain with no other buyers or sellers means you can sell your house fast.

But you’ll still need to find a buyer first.

However, once a no-chain sale is agreed, the conveyancing can move very quickly.

Quick reminder:

Conveyancing means the legal process that comes after your sale is agreed.

It involves local searches, enquiries from your buyer’s solicitor, and the transfer of property deeds.

It can take anywhere from several days to several months.

Understanding chains is a little complicated.

We’ll explore it in further depth in the next section ‘What do you mean by chain free?’.

But to define a “no chain” buyer – it’s someone who fits one or more of these categories:

Finding a buyer like this is an ideal scenario. It may just have the biggest influence on the speed of your sale.

A buyer with no chain who’s also using cash is even better.

We’ll talk more about this in the section ‘Is it better to sell your house to a cash buyer?’.

In property-speak, a chain is everyone involved in the selling and exchanging of property.

This includes the people buying from you, their buyer, and so on.

It also means the people you’re buying from, the people they’re buying from, and so on.

Most transactions have a handful of people in the sale.

But the longer the chain, the more complicated it gets. And it becomes less likely you’ll be able to sell your house fast.

This is because with more players in the game, more can go wrong.

If your buyer’s buyer pulls out, he will no longer have the money to buy your house.

You’ll either have to wait for them to find a new buyer, or find a new buyer yourself.

In a similar way:

If the people you’re buying from lose the house they’re buying (known as the onward purchase), your sale and everyone else’s below you will grind to a halt.

In that case, you’ll have to wait for them to find another property to buy. Or you could look for another property to buy.

The best thing you can do to sell your house fast is to find a buyer with no chain.

To speed things up even more, you can also try to find an onward purchase with no chain. This means there are just three people in your chain:

That means just three sets of conveyancing to get through.

There are usually just two estate agents involved. Only three sets of solicitors need to communicate. And it shouldn’t be complicated to agree on a completion date.

Completion dates can be a big factor in sale speed.

If one party in your chain goes away for two weeks, another has a baby, and another encounters a difficult life event, completion dates can be very difficult to agree on.

It can mean weeks are added before you can swap keys.

You can speed things up even more by reducing your chain to two.

You’ll still need a buyer. But can you take your onward purchase out of the equation?

This means finding an alternative to buying your next home. You might move into a rental if you can afford it. You might stay with friends or family.

It’s good to be aware: finding a new home can take longer than expected.

The market can rise or fall at any time. If you’re moving into temporary accommodation, make sure you can budget for plenty of time.

But this scenario does make you very appealing as a seller. It means just two parties (you and your buyer) are involved.

Only you and your buyer need to align on completion dates. There’s just one estate agency and two solicitors to deal with.

Finally, you won’t have to wait for a seller’s conveyancing to go through. You’ll be able to move as soon as you and your buyers’ conveyancing is complete.

Finding a cash buyer can help you sell your house fast.

There are very few downsides to cash house buying. And there are two major perks.

They’re not restricted by a mortgage:

Mortgages can come with all sorts of problems. Banks and building societies pick and choose who they’ll lend to. They dictate how much they’ll lend.

Affordability criteria are so high now, many buyers are cut out of the running. Lenders can also refuse to lend for a whole heap of reasons.

They might refuse to lend because of dereliction, structural problems, extreme damp, unsafe land, or issues with building regulations.

They might not lend if the lease is very short, or has a flying freehold. Following the Grenfell disaster, many are now refusing to lend if a building has a certain type of cladding.

Cash house buying helps you to avoid all of these potential pitfalls.

They’re not bound by a chain.

Cash buyers don’t have any buyers below them. This means they’re not relying on other transactions to go smoothly. They are usually able to exchange and complete very quickly.

It should also be easy to agree on completion dates with a cash buyer. Often, they’re not selling the place they currently live in. They might not need to worry about booking removals.

There is of course one catch when it comes to cash house buying. Cash buyers are aware of how in demand they are.

A cash buyer might use their strong negotiating position to offer you less money.

They know you might take a lower price in exchange for selling your home quickly.

Of course, you don’t need to accept a low offer.

Here’s the kicker:

If your house is in high demand, your cash buyer will need to offer more money to compete with other buyers.

But if you’re struggling to get interest, you might feel pressured to accept.

You never have to accept an offer you’re not comfortable with.

Your estate agent will help you negotiate. They’ll also advise on whether they think the offer is fair.

If you have no other interest and you want to sell your house fast, it often makes sense to accept.

For the purposes of selling your home fast, we recommend cash house buying.

That’s whether it’s through a person or a house buying company.

Accepting a lower offer from a cash buyer might feel a little painful, but it’s a good route to selling your home quickly.

Here’s what you can do next:

If you’re looking to sell your house, it’s increasingly important to speak to a house buyer that cares.

And how can you distinguish one that cares from one that doesn’t?

Simple, if you call a company and the Managing Director picks up the phone ready to help you and answer your queries, then chances are this company cares. Since the Managing Director is personally speaking to each customer and giving them expert advice.

But if you call a company and some random sales representative picks up the phone, and is reading of a sales script, then chances are you’re just another number in their system.

Would you like to have a 5-min phone call with our recommended house buyer, simply to discuss your situation and your best possible solutions?

A zero obligations call where you speak with the actual Managing Director of our top recommended house buying firm.

We recommend people speak to him because he has a very unique ‘no-nonsense’ approach.

He’ll tell you honestly what’s your best solution moving forward and if they can help you sell your property.

In the rare off-chance they can’t help you, he’ll give you expert advice on how to proceed. You are NOT tied to any contracts.

If you want us to connect you to the Managing Director of our top recommended house buying firm, click to open our Sell House Fast safe connect page.

It takes less than 1 minute and you will get the most genuine advice in this industry.

Let’s say you’ve decided to sell and you’re ready to get going.

How do you get on the market as fast as possible?

Your house doesn’t have to be in perfect shape to sell. Despite what many people think, you don’t need to fix everything up. Many buyers will want to put their own stamp on it.

They may want to replace kitchens, bathrooms, and colours on the wall. So there’s not much point spending time and money on big jobs.

So, here’s the deal:

If you want to sell your house fast, don’t commit to major works that can drag on.

Your main job is to get a spare set of keys cut for the estate agents. If the property isn’t lived in, get the heating on and windows open.

There are of course things you can do to make it more appealing. We’ll explore the jobs worth doing in section ‘What to fix up when selling a house’.

But first let’s look at the biggest factor in getting on the market: your estate agent.

If you’re using a traditional, high-street estate agent, you’re relying on their timescales.

For this reason:

Estate agents will be keen to win your business. But they’ll need to find time to visit and value. Remember: it’s a good idea to get two or three different opinions.

Then they’ll need to draw up a contract, take pictures, and arrange things like floor plans and EPCs.

That’s before they get to arranging viewings.

If you want to sell your house fast, your first job is to call an estate agent.

You can request they bring tools for measuring and photography when they come to value.

That way they can get your house online as soon as possible.

You might want to ask they only take ‘proceedable’ viewings.

This means people who are ready to buy. They might have a buyer lined up for their house.

Or they might be one of the “no chain” buyers we looked at in the section above ‘How long does a house sale with no chain take?’.

This way you’re not wasting time with people who can’t actually buy. But things can change quickly.

They might not be ‘proceedable’ immediately, but they might be motivated to get proceedable if they like your house.

Your estate agent should be advising you on who’s worth your time.

It’s also good to get a solicitor lined up early. That way they can start the conveyancing as soon as you sell.

Here’s where it gets better:

If you’re using a homebuying service, there’s none of this to worry about.

You don’t need to redecorate or even tidy.

And you don’t need to wait for advertising material to be made or the viewings process to start.

The general agreement is: furniture is better if you want to sell your house fast.

A furnished house looks warmer and more appealing. The rooms also look bigger.

Have you ever moved house and looked back on your furniture-less rooms?

Not only do the rooms look smaller, marks and scuffs on skirting and walls become really noticeable.

Moving furniture can leave unsightly marks on carpets. It can reveal stains on floors.

It can also be hard for people to imagine the house with their furniture in it.

You don’t need to have lots of furniture. Simple things like sofas and beds help buyers to envision their potential new home.

You might consider a couple of “finishing touches”.

Leafy green plants can completely change the feel of a room.

Lampshades always look better than bare light bulbs. Large mirrors help create an illusion of space.

You don’t need to present a perfect house.

But there are a few things you can do that maximise appeal and help sell your house fast.

These include:

Naturally, major works needed will likely affect the speed of your sale. Major works means things like subsidence or if your roof is falling in.

Buyers will need to get surveys on houses with major works needed. Surveys take time to arrange.

And if they come back with alarming results, your buyer may pull out.

There’s no way around this. The best thing to do is be honest about the work needed.

You might even pay for a survey yourself ahead of time.

You can then show it to buyers before they commit. It might help you avoid agreeing a sale and having them pull out further down the line.

Let’s say you want to make some money from your property. What can you do to maximise your sale price?

Before we begin this section, note that adding value may not help to sell your house fast.

Remember the speed, quality, and price triangle. A high quality house at a high price might not translate to a quick sale.

Making your house more expensive may shrink your pool of potential buyers.

You’ll also need to factor in time for renovation. There may be time-consuming admin that comes with it, like planning or building regs approval.

But the longer you spend decorating and holding out for the right buyer, the more money you could make.

There are 3 big factors in the value of a house.

Number of bedrooms.

The more bedrooms a house has, the higher its value jumps. Adding a bedroom is usually the biggest value add you can make.

But this has to be offset against two things.

If you’re extending or converting a loft, you’ll need to make sure you make more money than the cost of your extension.

Always check market values before you begin. You might already be commanding a top price for your area.

Let’s say your house is currently worth £400,000. Over the past 3 years, houses on your street have sold for between £375,000 and £425,000.

Spending £50,000 on an extension might mean you can get £450,000.

That’s because the price would be unrealistic for the area. Mortgage lenders will rarely lend higher than fair market value.

If you’re not extending, make sure you have the space to convert.

Ending up with two tiny bedrooms is not necessarily better than one big one. The same goes for converting a loft.

You can end up with very restricted head height, or lost hallway space for the staircase.

Overall condition:

New fixtures and fittings will help your property’s value. But you need to be careful to appeal to all tastes.

A very expensive kitchen or bathroom will add value, but only if people like it.

Things like windows, doors, and new boilers may add some value.

The general finish of your house (think walls and carpets) might not add thousands in value, but they will help justify your asking price.

If you’re going to add a new kitchen or bathroom, it doesn’t usually make sense to go for the priciest.

But it doesn’t make sense to go for the cheapest either.

Adding real value requires you to spend the money. People willing to pay a good price will want to see quality and workmanship.

Outdoor space, outbuildings, and parking.

People like gardens, garages, and driveways.

You can’t make your plot bigger, but you could build a driveway onto your front garden.

Applying to the council for a dropped kerb for driveway access can help the value.

Clearing or repurposing outdoor areas can help.

For example, a derelict old shed might look better as a decking area.

Think about the way people live in your area. If it attracts lots of people escaping the city, they are likely to want “lifestyle” gardens they can enjoy.

If it attracts busy young professionals, they might want low-maintenance outdoor spaces. The first group might want lawns and potting sheds.

The second group might prefer paving or AstroTurf.

Many people need home offices now.

You might convert an outbuilding or garage into an office. Again, weigh up the buyer type and cost of investment.

Families may prefer a garage, young professionals may prefer an office.

Remember – although they might be luxurious, things like swimming pools and hot tubs don’t add value.

Not everyone will want one, and they tend to cost homeowners more money in the long run.

We conducted an independent research study to estimate the overall property selling dissatisfaction rate in the UK.

This means what percentage (%) of people in the UK were left dissatisfied after they sold their property.

The dissatisfaction could be due to a low selling price achieved, bad customer service and other unethical practices.

We aimed for a relatively high statistical significance, hence the sample size we took is 100.

This includes 20 house buying companies, i.e. sell house fast companies, and 80 estate agents.

The ratio is such because out of the hundreds of house buying companies that we examined, only 20 matched our criteria (outlined below).

Also, there are many more estate agents in the UK than house buying companies. Therefore, by default, the overwhelming majority of our sample size will consist of estate agents.

Overall, we analysed hundreds of Trustpilot company profiles and took into consideration only those that matched our criteria.

Qualifying criteria:

First we combined all of the 1,2 and 3 star reviews within each individual company, then between all the companies in our sample. The aggregate result was divided by 100 in order to procure the average percent of dissatisfaction.

The property selling dissatisfaction rate in the UK equated to 18%.

This means that 18% of people were not satisfied with the way their property was sold. Either due to bad customer service on the company’s behalf or other unethical practices which alienated the customer.

We want to help out as many people as possible. That’s why we created this comprehensive article.

If you are looking to sell your house fast or at a more reasonable pace, call us on 0333 242 2814 or message us through the live chat.

Depending on your preference and circumstances, we’ll connect you for free with one of our strictly vetted, ethical partners.

They will help you sell your property for the best offer you can realistically achieve.

They will take care of all of the legal processes and fees and you’ll get the cash straight into your bank account.

With our partners you can achieve a very fast sale or a slower one if you’re not pressed on time.

Faster sales usually yield a lesser price but they save you time.

It all depends on your circumstances and preference.

As with most things in life, there’s usually a trade off if you want to sell your house fast.

Lowering your price will help you sell quickly. Holding out for longer might get you more money.

It all depends on your priorities.

Taking a lower offer might feel a bit painful.

But holding out for a higher price that never comes is even worse.

This is particularly relevant if you’re selling an empty home.

An empty rental property costs you money every month.

A probate sale (for example, a deceased parent’s home) will quickly deteriorate.

A speedy sale at a lower price can save you money in the long run.

Here’s the key takeaway:

A house is only ever worth what someone is willing to pay for it.

If you’re not achieving the price you had in mind, or even the price your estate agent quoted, it might be that the market just doesn’t support it.

More To Explore

The Complete Guide:

Selling Your House After a Divorce

Read More >>

All-inclusive Guide:

Selling a Property After the Death of Parents

Read More >>