Looking to sell your property fast but not sure who to trust? Complete our contact form

Critical Analysis:

When you’re selling your property, it’s of vital importance to know who you’re working with.

In here, you’ll find everything you need to know about National Homebuyers and whether you should trust them to sell your property quickly.

Want to hear who we recommend above National Homebuyers?

We have independently investigated all the best cash home buyers in the UK.

We ranked them based on their cash offers, reliability, customer service and 15 more metrics.

And we discovered that ‘My Homebuyers’ are superior to ‘National Homebueyrs’ in every regard.

My Homebuyers will give you the best genuine cash offer, without contracts and without any fees.

Click the button below to see exactly why we recommend My Homebuyers as your best option.

And how you can use the free Safe Connect™ programme to get VIP treatment from them.

Company

Established in

2004

Members of NAPB

No

Members of TPO

No

Registered with ICO

Yes

Approved by CTSI

No

Will “National Homebuyers” pay all of your legal fees?

Up to £1000 upon completion

Do they ask you to sign a contract?

Yes

Government verified transactions

No

Cash offer

Average sale time

30 days

Fastest sale time

14 days

Availability

9AM – 5PM (Mon-Fri)

Complaints procedure

No

Customer service

4.0 / 5

Google rating

4.1 / 5

Trustpilot rating

4.5 / 5

Reviews.co.uk rating

N / A

Feefo rating

N / A

National Homebuyers are a well-established UK house buyer. Their cash offers are fair and they have a team full of experts. However, they’ll also ask you to sign a contract.

If a house buyer asks you to sign a contract, you should read the fine print through a magnifying glass. Don’t skip on any of the terms and conditions because dodgy companies sometimes leverage such contracts to mislead you.

But in other instances, contracts are necessary due to the way a house buyer operates. That’s why you shouldn’t take their word for it. You should verify the stated claims in the contract for yourself.

4.2 / 5

(source: Companies House)

National Homebuyers is a UK cash house-buying company.

You might’ve seen them on TV as they have been advertising on some of the main UK channels since 2004.

They claim to be able to sell any property in any condition quickly and without headaches.

Many such house buyers in the UK claim to do the exact same thing. What makes National Homebuyers different?

Well it turns out they do have some unfavourable aspects that you should consider before contacting them but on the flip-side they also have a couple of redeeming qualities.

We’ll reveal everything you need to know about National Homebuyers in this review.

When working with them, they’ll buy the property from you at a price that satisfies both parties involved, and then sell it for a profit.

You’ll get a slightly below-market price but you’ll achieve a prompt and effortless sale with little bureaucracy.

National Homebuyers provide free cash offers and will cover up to £1000 of your legal fees, but only after the sale of your property has completed. This means that you’ll have to pay out of pocket and then recoup your losses later.

They can give you a quick no-obligation quote and buy your property relatively fast.

This type of sale is perfect for people in a rush, who don’t have time for unnecessary red tape.

It’s important to remember:

You won’t get the full market value of your property but you’ll sell it very fast.

In fact, this is by far the fastest way to sell. A typical estate agent will take 6-9 months whereas a fast home-selling company can do it in mere days.

You’re sacrificing a negotiable percentage of cash for an exponential increase in speed-of-sale and a major reduction of headaches and legal complications.

Being one of the older home buyers in the UK, National Homebuyers are still in business for a good reason.

They seem to provide a fair service and have a team full of experts that will assist you in selling your property quickly.

And they will pay up to £1000 of your legal fees upon successfully selling your property.

However. National Homebuyers has some unfavourable company aspects which you should take into consideration if you decide to work with them.

No, National Homebuyers isn’t a member of the NAPB.

The National Association of Property Buyers (NAPB) was specifically set up to protect homeowners looking to sell their houses for cash to a property buying company.

The NAPB continuously screens its members in order to see whether they’re maintaining the necessary business integrity, legality, professionalism and customer service.

It’s mandatory for all NAPB members to also register with The Property Ombudsman (TPO) and abide by the TPO ‘Code Of Practice For Residential Buying Companies’.

However, being an NAPB member itself, is completely voluntary. Nobody forces these cash home buyers to become members, they do it of their own volition.

From our field observations, we can say that the very best house buyers in the UK voluntarily become members of the NAPB, and in turn, also become TPO members as well.

The fact that National Homebuyers aren’t NAPB members is slightly alarming but not necessarily a deal breaker.

No, National Homebuyers isn’t a member of TPO.

The Property Ombudsman (TPO) defends the interests of the public by investigating and addressing complaints of maladministration or a violation of rights.

It has been providing consumers and property agents with an alternative dispute resolution service since 1990.

TPO has a specific category for fast home sale companies, such as National Homebuyers.

These companies have to adhere to a strict ‘Code of Practice for Residential Buying Companies’.

As stated in the section above, National Homebuyers aren’t TPO members also. Again, this isn’t mission critical but it’s definitely not optimal. It means that if in the rare off-chance you’re not satisfied with National Homebuyer’s services, The Property Ombudsman won’t be able to assist you in resolving whatever issues you may have.

Yes, National Homebuyers have been registered with the ICO since 12th December 2019.

The Information Commissioner’s Office (ICO) is the UK’s independent regulatory body set up to uphold information rights.

The ICO also governs all forms of data collection and advertising intelligence.

By being registered with the ICO, National Homebuyesr has to protect its customers’ data at all times.

The ICO also has a free online checker where you can verify whether a company is registered with them or not.

National Homebuyers are registered with the ICO which shows that they are proactively trying to keep your personal information secure.

They are mostly GDPR compliant.

From our independent investigation, we discovered that nationalhomebuyers.co.uk is fully GDPR compliant with the “safety of personal data collection forms”.

However, nationalhomebuyers.co.uk doesn’t seem to ask for consent whenever you are submitting your personal details.

This isn’t necessarily a bad thing and it doesn’t mean that they don’t keep your data secure. Sometimes companies try to make it as easy for the customer to send an enquiry. Therefore, take this with a large grain of salt.

Everything else National Homebuyers does seems up to standard. They do not transmit data to inadequate countries and there are no other major risks of data breaches.

We cannot say for certain whether National Homebuyers have cash on hand or not.

Our investigators found National Homebuyers’ investment vehicle within Companies House but there were only a few government-verified transactions.

They might be using a different company name to track and register their Companies House transactions. Therefore, this isn’t a major reason for concern but you should keep it in mind.

For example, our recommended house buyer has government verified transactions. You can find more on that below or at the very top of this review article.

Since we cannot say for certain whether National Homebuyers have or don’t have cash on hand which they use to buy properties, we cannot recommend them.

In general, we’ve discovered that very few fast home-buying companies actually have disposable cash on hand.

Most of them are unregulated small businesses or worse – individual opportunists pretending to be big organisations who deliberately mislead.

These companies don’t have their own cash but attempt to raise funds by low-balling their offer and getting finance off the back of the difference between their offer and the market value.

For this reason, it’s less risky to work with home buying companies that have government verified transactions.

Yes, National Homebuyers have traded for more than 5 years.

We use the ‘over/under 5 years trading time’ as a metric to gauge whether a company is an established entity with a lot of experience under their belt or just a newly founded business that may have ulterior motives.

Not all newly formed companies are scams but it’s still important to check how long they have traded.

If they’ve traded for more than 5 years, then this is a minor but still a notable vote of confidence.

And it needs to be acknowledged.

The average cash offer of National Homebuyers is approximately 70-75% of your property’s market value.

They do cover up to £1000 of your legal fees but that’s after you complete the sale. Which means that initially you’ll have to pay the legal fees yourself and then they’ll refund you up to £1000.

So if you’re strapped for cash, this might be inconvenient.

Our recommended house buyer, for example, directly covers all of your legal fees. You don’t have to pay anything out of pocket even if the fees exceed £1000.

Nevertheless, National Homebuyers are still better than a generic estate agents in this regard. The estate agent will have a myriad of legal fees which will indirectly reduce the market value of your property.

Getting 70-75% of the market value for your property when working with a fast home selling company such as National Homebuyers is quite fair.

However, you can get 5-10% more if you go with a house buyer who prioritises customer satisfaction over profits, such as our recommended house buying company.

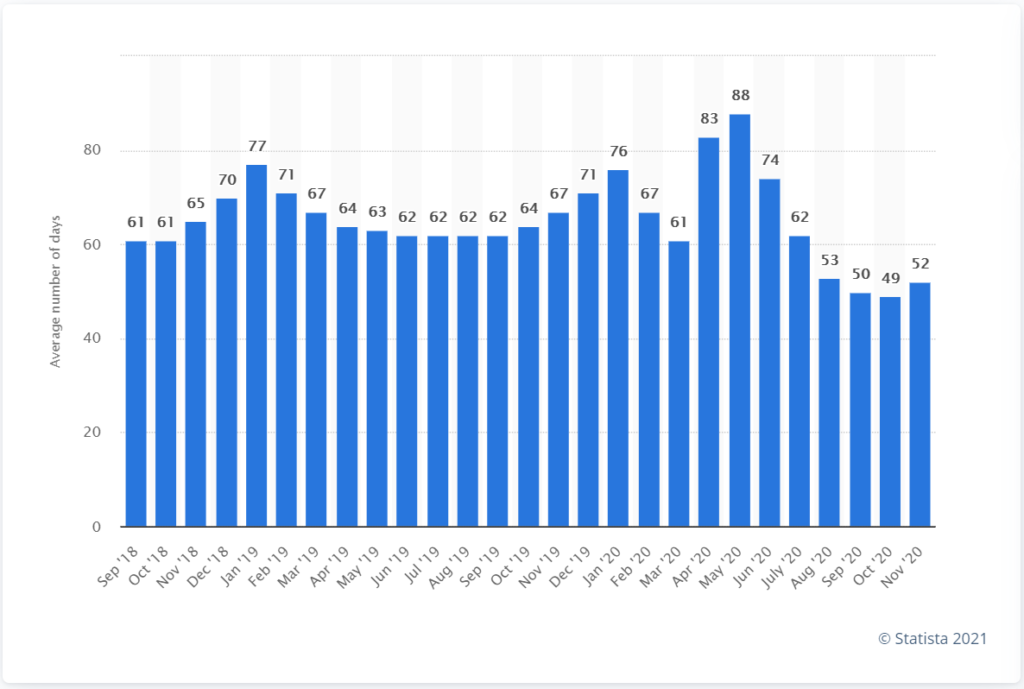

According to the latest Statista research, the average number of days taken to sell property in UK from September 2018 to November 2020 is 65 days.

This includes selling properties via estate agents, actions, fast-sale companies and everything else under the sun.

Again, this graph represents every single method of selling a property, combined together.

And because of the vast number of fast home sale companies in the UK, this number is considerably lower than what it would’ve been if it only were estate agents and actions.

Remember when it comes to speed of sale, nothing beats a quick home buying company:

National Homebuyers’ average sale time is 30 days and their fastest recorded sale time is 14days.

Remember:

With a quick home-buying company, you’re sacrificing a negotiable percentage of cash for an exponential increase in speed-of-sale and a major reduction of headaches and legal complications.

That’s why you need to carefully consider your options.

Do you want a bit more money or do you want a significantly faster sale?

Supporting a charity is by no means proof that the home buying company in question is necessarily ‘good’.

In fact, dodgy home buying companies might purposefully support and/or pretend to support a charity just to win brownie points and credibility in the eyes of the customer.

National Homebuyers claim to support the British Heart Foundation but we couldn’t verify that.

It’s important to recognise and shed light on a home buying company’s altruistic and philanthropic aspirations but only if they are truly genuine.

If we discover even an ounce of shady behaviour, rest assured we’ll report it in our review.

We didn’t find anything that raises suspicion during our thorough research of National Homebuyers.

Our investigators sifted through all of the data and legal records of National Homebuyers and everything was clean.

However, we’ll redact this paragraph at the first glimpse of dodgy practices.

We never stop researching and our unbending commitment to excellence doesn’t waver.

This paragraph is only valid up until the ‘Last Updated’ date of this review, which can be found at the top of this page.

As far as we are aware, National Homebuyers haven’t received any additional awards or prizes.

They haven’t won any competitions either.

There’s nothing more we could add.

To assess the overall user experience (UX) of nationalhomebuyers.co.uk, we first analysed their website for ease of use and intuitiveness.

Their website is a slightly confusing at first glance but you can get a cash offer buy submitting your details on the homepage.

Also, they have a FREEPHONE number which you can use to contact the company every working day from 9 AM – 5 PM.

But they are not available on the weekends.

They don’t have a live chat features so we couldn’t estimate their First Response Time (FTR).

A fast FTR is something we consider highly important, especially in this sector.

Because faster response time suggests that the home-selling company is better equipped to deal with customer queries.

And if they’re better equipped to deal with customer queries, then it means they’re investing their resources where it matters the most.

We also asked if they offer some sort of ‘Client Satisfaction Guarantee’, and if yes, what would that guarantee consist of.

They don’t offer a Client Satisfaction Guarantee. And since they are not a member of the National Association of Property Buyers and The Property Ombudsman, this makes it difficult for their clients to pursue any type of complaints.

In this turbulent market, a fast home buying company should preferably have a formal complaints procedure on their website, where clients can express any disagreements, issues or just plain dissatisfaction with the overall service.

By having such a complaints procedure in place, the home buying company shows that they are willing to listen and if possible, rectify any problems that may arise.

National Homebuyers don’t have a complaints procedure.

And as mentioned above, since they are not a NAPB nor a TPO member, you can’t submit a complaint via the TPO either.

This is definitely something you should keep in the back of your mind, if you decide to contact National Homebuyers. Because if something goes wrong, you won’t have a formal complaint route.

A legitimate quick home buying company that does what it promises shouldn’t have a problem letting you speak to their past customers.

Of course they need to have the permission of the individual involved and provide some kind of proof that it is a genuine past client of theirs.

We strongly encourage all our readers to ask to speak to a past client.

In this section, we’ll discuss what the public thinks of National Homebuyers and what online reviews the company has received.

Keep in mind that online reviews can be easily faked.

It works both ways.

The company in charge might hire fake review writers to write positive reviews.

Or on the other hand, their competitors might hire fake review writers to write negative reviews and tarnish the said company’s reputation.

Also, social media followers can be artificially inflated.

That’s why we deem this section as purely anecdotal.

Nonetheless, we use trained researchers with a sceptical eye to go through National Homebuyers’ social media presence and online reviews.

What’s not anecdotal is the Domain Rating (DR) and Search traffic (ST) metrics.

The Domain Rating is an internet metric that shows the strength of a website.

The longer a website has been online, generally the more other websites link back to it.

These are called backlinks. Backlinks are like a minor vote of confidence.

It’s rare to see a a scam website with a high Domain Rating. Why? Because other websites realise it’s a scam and they never give their “vote of confidence” to them.

The more backlinks a website has, the higher their Domain Rating will be.

For this reason, we only advise you to work with websites with a Domain Rating of 10 and up.

However, it’s still important to remember that virtually any online metric can be falsified or faked these days. Therefore, take this with a grain of salt and don’t give it much importance.

The Search Traffic is an internet metric that shows approximately how many unique visitors a given website has per month.

Also, this metric is an average evaluation over a period of several months.

Therefore, the more Search Traffic a company has, the less likely they are a scam.

Scam companies don’t have recurring visitors because once they scam someone, the victims protest and tell other people online to beware of the said scam company.

Also, scam companies appear less frequently in the top Google results because they usually have lower Domain Ratings. And Google only ranks websites with a high DR at the top.

This makes the scams unsustainable over a long period of time, and therefore, they cannot have a high Search Traffic.

The Domain Rating and Search Traffic are directly proportional. If the Domain Rating is high, then the Search Traffic will be high also, and vice versa.

All of the below stats and metrics have been taken as of the last updated date which can be found at the top of this review.

We didn’t find anything suspicious with National Homebuyers’ social media, TV and online presence, nor with their customer reviews.

We also didn’t find anything suspicious with their domain rating and backlink profile nor their unique monthly search traffic.

At the time of writing this review, National Homebuyers doesn’t receive the Property Sale Watchdog woof of approval. And we can’t recommend them as the best cash home buyer in the UK.

Check the next section below to see which house buyer is better than National Homebuyers and why. And how you can get our most recommended cash offer.

However, National Homebuyers is a definitely a legitimate UK fast home sale company. They have been operating in this market since 2004 and they aren’t a fly-by-night company.

We thoroughly examined their strengths and weaknesses, user experience (UX), customer service and overall online presence.

National Homebuyers aren’t members of the NAPB and TPO, nor are they approved by the CTSI, but they are registered with the ICO.

They give somewhat decent cash offers and they can buy your property in mere days.

They don’t fully conform with all GDPR regulations.

They do not have a dedicated complaints procedure and because they aren’t a TPO member, you have no easy way of submitting a complaint if anything goes wrong.

We’ve independently investigated all the UK’s top fast home buyers with our cast-iron 18 point checklist.

And by using the free Safe Connect™ programme we’ll introduce you to our most recommended & strictly vetted home buyer.

The Safe Connect™ programme was created to ensure you not only get the best possible, genuine cash offer, but also to protect you in this unregulated market.

If you click the orange button below, we’ll automatically Safe Connect you to the best property buyer in the UK – as vetted by our team of investigators. And most importantly, you’ll see exactly why we objectively classified them as the best property buyer in the UK.

If you use the Safe Connect™ programme to connect with a cash home buyer, we’ll personally hold them accountable. We’ll ensure they go the extra mile and treat you like a VIP.

The Safe Connect™ programme is a free service. There are no additional fees or costs on your end.

Safe Connect™ ensures there will be no last-minute price drops and no nasty surprises. It’s quick, easy and it eliminates all headaches.

Our strictly vetted partner will know that you’re coming through Property Sale Watchdog and they won’t dare to mess you around.

National Homebuyers is just one of the many fast home-buying companies in the UK.

In order to make sure you choose the right one, it’s best if you compare them all.

Look at their strengths & weaknesses, their pros & cons and make an informed decision.

It’s essential to know you’re in safe hands, that’s why we’re here to help.

Use our company comparison table to find a reliable and trustworthy service, and decide whether expediting the sale of your property is the right thing for you.

This review is being constantly screened by our investigator team and will be corrected in line with the emergence of new evidence.

If a company contacts us with a genuine and verifiable piece of information which supports their cause, then we’ll immediately redact the review and point to the new information.

On the other hand, if we discover that a company which we’ve previously praised for a certain industry trait, starts to dabble in dodgy practices, we’ll also redact the review immediately.

We’ll point to our new findings and we’ll adjust the table metrics and scores accordingly.

For this reason, make sure to take notice of the ‘last updated’ date at the top of this page.

More To Explore

The Complete Guide:

What is a Memorandum of Sale And How to Use it

Read More >>

The Bulletproof Guide:

How to Sell Your House Fast and What's the Catch

Read More >>